Lol. Lmao.

In the funniest timeline, the US nationalizes Nvidia to delay China from making chips that work well with LLM’s… by a year tops.

Link to original Fortune article the PC Gamer article pulled from, with this juicy relevant quote:

To do that, Raimondo said the Commerce Department’s Bureau of Industry and Security, which manages export controls for the US, needs more funding from Congress.

“I have a $200 million budget. That’s like the cost of a few fighter jets. Come on,” she said. “If we’re serious, let’s go fund this operation like it needs to be funded.”

I love the fact that the burger government measures money in warplanes, no matter which department.

They are one of our more dollar-intensive ordnance delivery vectors.

they are great at delivering ordnance into the open ocean during peacetime

Nah, I’d say that’d be fuel they’re better at dumping into the water than anything. The bombs go into dirt nine times out of ten during practice.

a new unit of measurement to join burgers and football fields

Removed by mod

hell just on the numbers China has more and better real artists than we have prompt monkeys

deleted by creator

National Graphics Card Corporation mass produces affordable mid-range graphics cards and restricts sales to crypto and AI startups for “national security reasons”, causing graphics card prices to fall, but because Elon Musk doesn’t get 10 more fps when he upgrades to the 8090 Super Ti ™ the West has fallen and it’s time to end those commie democrats and their big government

Chip manufactures should think twice about headquartering in the US. Why get caught up in a sanction war when you could just not.

Nahh, that doesn’t work. ASML for example, is based in the Netherlands. The Amerikkkans just placed sanctions on “products using US technologies and patents”(which applies to like 99% of the stuff made in the world) instead.

This is one of the ways they fuck over Cuba btw. Its not enough to just not have any components made in the US or any money from a bank with significant US ownership (ie…most of them). You also can’t use any US intellectual property, and the US has made it so that interlocking patents mean no components ever become public domain.

FREE TRADE

“We are the reserve world currency”

“Wait, no, don’t do THAT with the currency! THAT’S NOT ALLOWED!!!”

She wants to nationalize a company? Any chance the CIA pull the heart attack gun out of storage to remove her?

I was joking about the nationalization thing, she’s just threatening export controls on Nvidia.

Might be the only way for them to keep nvidia american if they start to consider moving.

We nationalized a whole pharmaceutical company and nothing really came of it, why would this be different

Nvidia is THE leading firm in the GPU space and it’s not even close. It would be like the US govt nationalizing Pfizer + GSK + J&J at the same time

China’s already building their own microprocessors though

Right, but as I understand it China still has some catching up to do in terms of the technology and manufacturing? It’s amazing what they’ve accomplished so far tho, and they’ll probably fully catch up to and surpass Taiwanese manufacturing soon enough

Soon enough is not going to be as fast as you think. The issue is TSMC has a complete equipment and knowledge monopoly and we are not talking about a 5 or 10 year lead. We are talking more 15 to 20 on anyone that just wants to catch up at this stage.

I’m not sure that’s true anymore. China has done pretty well at poaching TSMC engineers, and the US embargo has essentially forced China to eat it’s own dog food and hothouse development. They’ve already regained capability far faster than the US anticipated. TSMC only has an institutional and hardware monopoly at this point I’d guess, Knowledge has already diffused into Mainland China.

Yeah. It’s actually Russia that is around 10 to 15 years from catching up. I’ve been following both the Russian and Chinese state firms in charge of developing semiconductor fab tooling. The main Chinese firm is about to make a full two or three generation leap past ASML (the top western firm) in the coming 3 or so years. The Russian state firm in charge of this type of tooling hasn’t made anything since shortly before the USSR fell, back when Russia still maintained semiconductor lithography tech parity with the US and only right around the time the Ukraine war kicked off have they started back up their r&d.

The new EUV light source and lithography machines China has going into trial production are more advanced than anything ASML (where TSMC & western fabs get their EUV light source) has in the works. China decided to leapfrog the western firms by skipping the inefficient method of vaporizing tin microspheres with a laser to make pulses of EUV light (extremely inefficient, low quality light) and instead is going with particle accelerators to generate continuous EUV light that is higher quality (greater culmination, narrower frequency range) and higher output (10 to 100 times brighter for given power input) while using less valuable fab infrastructure space. Because a particle accelerator lacks all the moving parts and is mostly solid state, it has many times greater mean time between failure compared to the ASML machines that have duty cycles around only 90% operational uptime and 10% maintenance downtime. Rather than needing to build/buy a dozen or more EUV machines to equip a fab at scale (one ASML light source per lithography station) and have them still be a production bottleneck, you can install a single one of the Chinese particle accelerator light sources to provide EUV light to more than a dozen lithography stations placed around the circumference of its ring.

edit:

another observation. the western lithography tooling firms seem to be at a tech development disadvantage because they make so much of their money from service contracts to maintain the machines they sell. I could never see ASML decide on their own to create the type of hardware Chinese state firms have in the works because the complexity and unreliably of their machines is a major source of revenue after they make the initial sale. Their board of directors and shareholders would never allow it. ASML would also never design a machine that can replace a dozen or more machines of the same cost even if it meant higher quality output for the end user. This is why I can’t see them competing in the long run now that China has made development of advanced lithography tooling a national priority with full backing of the state.

Hey, nice to see someone with some industry knowledge posting! I would extrapolate the “service contract” model’s inefficiency to the whole industry. It’s not just lithography, it’s also everyone from etch and defect metrology, to testing/binning and packaging. The big semiconductor names don’t build any of the production tools. TSMC, Intel, Samsung, and the other fab owners buy all of their tools from other companies, and those other companies sell them service contracts in order to more effectively hoard their IP.

A state-owned enterprise that does all of its own service and R&D would blow the capitalist firms out of the water. I estimate that 80% of the workforce at any given fab is superfluous, and only employed to safeguard each company’s IP. All of this increases production downtime, as the manufacturing technicians aren’t allowed to know enough to fix problems themselves and have to wait on the service company’s service engineers to show up to do anything more than the most basic tasks. On top of the actual manufacturing inefficiencies this model introduces, the capitalists from each company involved are taking their outsized takes from every transaction. Some of it goes to funding R&D, but a state owned enterprise would be able to redirect significantly more profits to R&D.

GOOD post

deleted by creator

It’s mostly path dependency. Semiconductor fabs are hideously expensive, you don’t want to build a new one from scratch every generation, and this tech is new. China having not invested in extensive lithography machine manufacture before now means they can jump straight to the best tech.

deleted by creator

Googled a bit but I have no idea how they’re generating EUV from a particle accelerator. It supposedly “captures the energy emitted by high-energy particles during acceleration”, but again, I have no idea how that would work. Are they just phrasing “and then it was slammed into a target” in a weird way?

Here are a few papers on the subject in chronological order:

Extreme ultraviolet (EUV) sources for lithography based on synchrotron radiation (2001) - https://www.sciencedirect.com/science/article/abs/pii/S0168900201008877

Steady-State Microbunching in a Storage Ring for Generating Coherent Radiation (2010) - https://journals.aps.org/prl/abstract/10.1103/PhysRevLett.105.154801

Demonstration of a ring-FEL as an EUV lithography tool (2020) - https://journals.iucr.org/s/issues/2020/04/00/ve5121/index.html

Experimental demonstration of the mechanism of steady-state microbunching (2021) - https://www.nature.com/articles/s41586-021-03203-0

A synchrotron-based kilowatt-level radiation source for EUV lithography (2022) - https://www.nature.com/articles/s41598-022-07323-z

Thank you, will give these a read later!

China is currently producing 7nm and will have 5nm by the end of next year. China reaching 3nm is more likely within 5 years, then the final catchup will be 2nm. 5-10 years is the maximum.

how do i apply to do this corporate espionage for the CCP

deleted by creator

I kinda doubt this is true. Gamers Nexus did a very interesting video recently ish about a Chinese made video card and it wasn’t as bad as you would expect. It had a lot of driver issues but as a graphics card it was more on par with a 10 year old card. This is for rasterization of course not AI but the company in question hasn’t been making cards for long, just a couple of years, and it is making headway fast. With the correct funding and interest I don’t see any reason why China can’t at least catch up to TSMC. Their processes are broadly understood, enough scientists with enough funding can figure it out.

Yeah. Moorethreads is the company iirc. To put things in perspective, Intel recently also got serious about competing with Nvidia and AMD on discrete GPUs. Intel already has decades of experience making integrated GPUs and has had multiple failed starts into the discrete GPU market but Moorethreads who started a couple years later than Intel’s most recent push, is at about the same stage of development as them.

Like Intel, they are a lot closer to Nvidia/AMD on hardware (roughly 4 - 5 years) than benchmarks make it seem but are being held back by just how much work it takes to bring the software driver stack up to the same level as Nvidia/AMD. Both Intel and Moorethreads are around 10 to 15 years behind Nvidia/AMD on driver software but this is a little misleading because both companies have decided to mostly abandon older graphics/compute apis (DirectX 9/10/11, OpenGL) to focus all their software development work on DirectX12/Vulkan. DirectX12 and Vulkan both have extensions that can handle software written for the older APIs at a 10 - 20% performance hit, which is a fair trade since newer software is more often than not DX12/Vulkan native.

With newer APIs like DX12 and Vulkan, less optimization happens at the graphics API/driver level with instead developers being given low level access to make the optimizations themselves. So, if they can get enough of these new GPUs into the hands of end users, developers will be forced to optimize games and applications for them. This is why both Intel and Moorethreads are just going into full scale mass production and selling their cards almost at-cost.

Intel is controlled by their US defense liaisons, accounting departments, and marketing departments. They will struggle where a company controlled by the manufacturing and design people succeed.

TSMC doesn’t make their manufacturing tools. They buy all of their production tools from other companies (ASM, KLA, Hitachi, Applied Materials, Tokyo Electron, etc), they only create the facilities and chip designs. It’s the same structure throughout the whole semiconductor industry.

They don’t create the chip designs, they create the manufacturing processes, which aren’t as difficult to catch up to as people think.

I work in manufacturing. If there’s is a will, there’s a way.

deleted by creator

Even TSMC’s own attempts to set up a fabrication plant in the USA is struggling horribly to find enough capable staff.

I don’t think TSMC is 20 years ahead of everyone else, but ASML’s EUV photolithography machines probably are, and those are under embargo to China too.

she made some particularly pointed comments on the subject during the Reagan National Defence Forum in California on Saturday

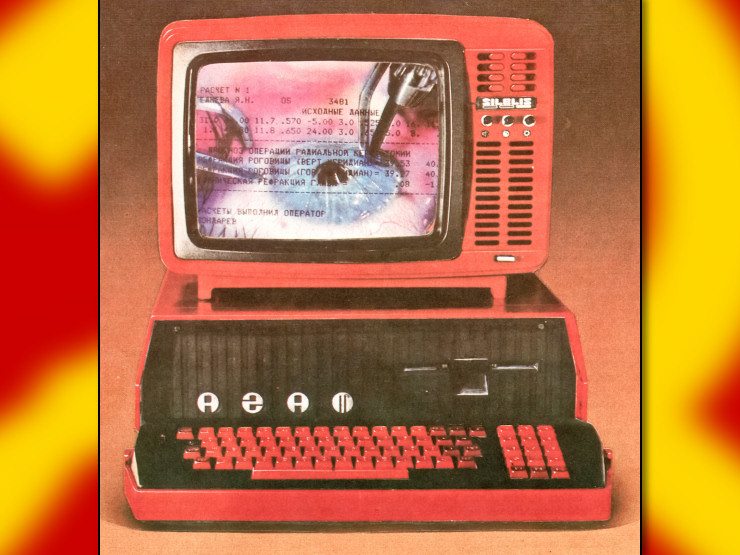

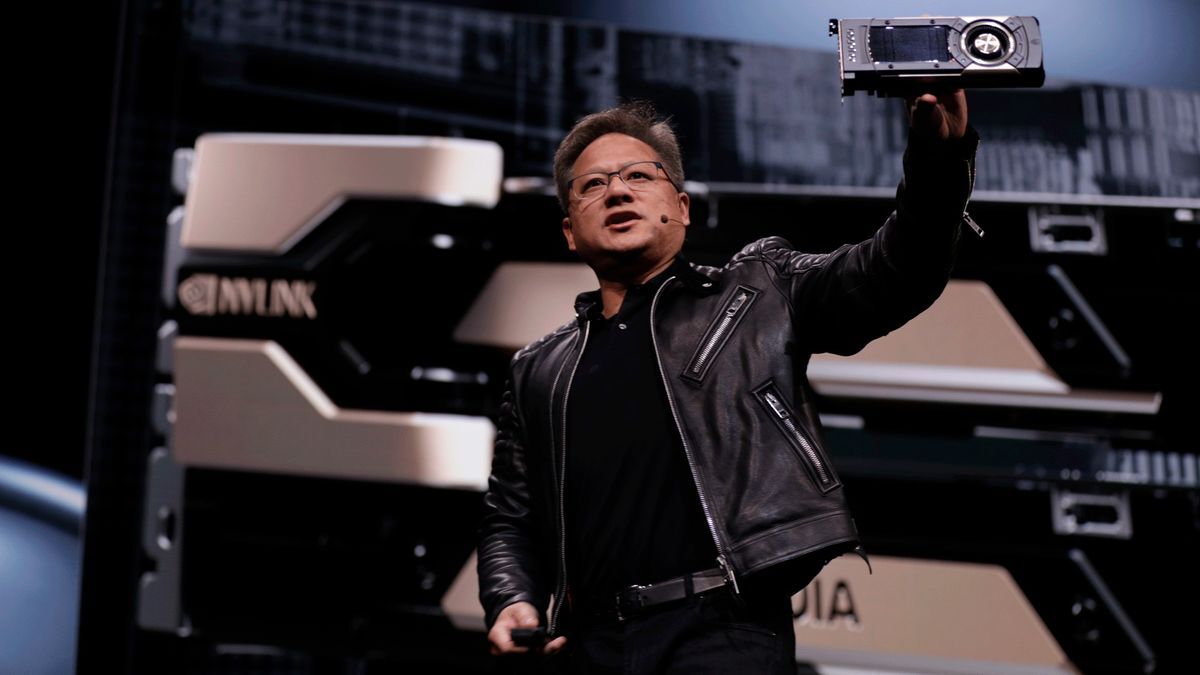

Jensen Huang and Nvidia about to receive a firsthand taste of FREEDOM and DEMOCRACY

To do that, Raimondo said the Commerce Department’s Bureau of Industry and Security, which manages export controls for the US, needs more funding from Congress. […] “I have a $200 million budget. That’s like the cost of a few fighter jets. Come on,” she said. “If we’re serious, let’s go fund this operation like it needs to be funded.”

Once there’s serious money for Cold War 2: China Boogaloo - it’s not going to the Commerce Department’s Bureau of Industry and Security. There will be a huge turf war involving the Pentagon, the CIA, the NSA, etc. They will all want the lion’s share of the money for themselves for what they’ll call something like “strategic interests AI”. And - of course - once they get that money they’ll want huge increases each and every year to counter the threats from foreign advisories.

PC Gamer got Melina writing their headlines now 😳

Petty shit. Nooooo we can’t let them generate weird hands!

… the big plan for the near future, our grand strategic vision; a vision shared amongst the thought leaders of the West, is entirely predicated on Chinese people not figuring out how to make computer chips

fr is there a technical reason why they are acting like China can never make this shit?

The whole point of US sanctions is to decouple, i.e. force China out of the world’s market and keep their technology separate from the ones under US control.

China is going to have their own indigenous, perhaps even more advanced technology, but so long as the US control access to the world market, and forcing Chinese technological development to be sufficiently deviated from integration into the rest of the world’s (i.e. US controlled) technology, the US would have achieved their goals.

The perils for China come not from their inability to reinventing the wheel or not catching up with Western technology, it’s that China does not have access to the international market when their manufacturing industrial base is critically geared towards export market.

The major “hinge point” happened back in 2009 during the global financial crisis, when dwindling Western consumption resulted in China’s infrastructure development and the booming of property market instead of reorientating their economy towards internal demand (internal circulation). As such, China now has the capacity of housing 6T people for a population of 1.4T - absolutely nobody is going to buy those properties because there are not going to be enough people to live in there. All the capital flooded into real estate for a quick fix (profit) rather than creating a strong domestic consumer base.

This is why China is undergoing a property market crisis today and it’s going to take them a while to sort this out. But the worse problem is that China’s consumer base is too weak to absorb the loss of international market for high end products. This was something they should have foreseen back in the early 2000s, and failed to correct course from the very beginning.

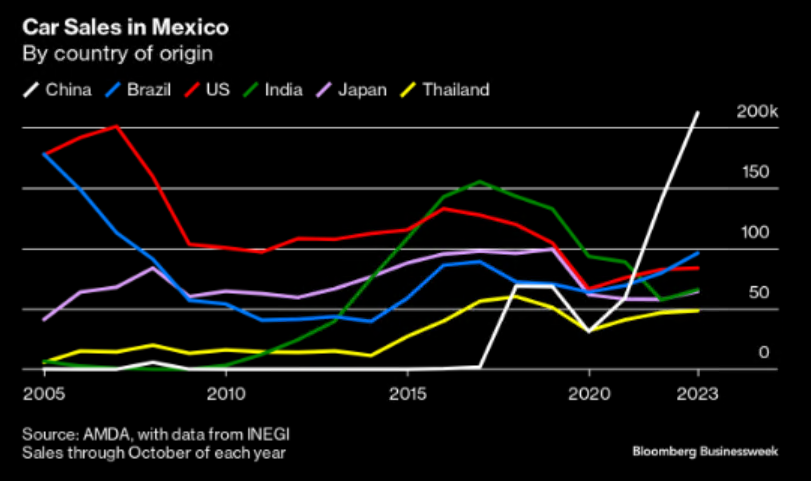

America’s only been partially successful at kicking China out of global markets, and China began correcting their trade a couple years ago. Now trade with Southeast Asia is huge. It is equivalent to or bigger than the EU or US.

what is “the world market” exactly ? China losing most of europe ,Korea, Phillipines and Japan? Like someone else pointed out Chinese mid and high end exports and intergration with most of SEA is going great and China is starting to dominate the market on digital infastructure in a lot of the devloping world elsewhere. USA has been unable to block the penetration and even domination of Chinese world leading mid-high tech exports in some of the worlds most important markets

For example ASEAN leads the world in growth and wants to repeat an “Asian Tigers” like development and China’s leading position in digital and physical infrastructure creates a natural economic partnership with them . Already in 2020, China exported almost twice as much to ASEAN as it did to developed Asia (Japan, Taiwan and South Korea). Chinese exports to the Global South, including ASEAN, Africa, and Latin America, nearly doubled from pre-Covid levels to an annual rate of around $900 billion in 2022 – double China’s exports to either the United States or the European Union.According to the IMF, the region’s per capital GDP in terms of purchasing power parity is $16,163, or nearly three times the USD dollar GDP per capita. The purchasing power of foreign currency in local economies is multiplied by the undervaluation of the region’s currencies. As the US dollar value of GDP converges with purchasing power parity over time and these countries grow, the import capacity of that 700 million people will rise to match western markets even in demand for high tech products . No reason to believe Chinese high tech exports and digital infastructure will not continue to rise even more.

From an ASEAN study published last year:

As ASEAN advances to become the world’s fourth largest economy by 2030, it is undergoing a transition marked by a demographic shift to a younger population, a rising middle class, and rapid adoption of technology. With many mobile-first markets in the region, ASEAN is expected to see rapid increase in the use of technology which would contribute to the growth of its digital economy by 6.4 times, from $31 billion in 2015 to $197 billion by 2025. The digital economy, therefore, is a key factor driving the growth of the region’s economy.

China is already a world leader in practical applications of digital infrastructure (AI/5G) and their strategy centers on creating future markets for its high end products by providing broadband, cloud computing, and training for Southeast Asian nations and in those aspects it already dominates the 700m people market with deals being signed left and right no matter US disagreements. .

According to a July 2022 report by the Carnegie Endowment on Huawei’s success in Indonesia, by far the largest ASEAN nation with a population of 275 million:

Huawei and, to a lesser extent, ZTE have successfully positioned themselves as trusted cybersecurity providers to the Indonesian government and the Indonesian nation. This has been no easy feat given long-held Indonesian animosity toward China. Many Chinese companies have faced protests over concerns they were taking local jobs. Huawei and ZTE have suffered no such fate. Nor has there been a broad coalition of Indonesian voices against using Chinese technology in critical telecommunications infrastructure. In short, Indonesians care a lot more about Chinese cement plants than they do about Huawei involvement in 5G networks.

Huawei teamed up with Thailand’s Ministry of Digital Economy to open a “Thailand 5G Ecosystem Innovation Center” in Bangkok in 2021, the director of Thailand’s digital development office told a Huawei conference in 2021. In October 2022, Huawei released a white paper entitled “Malaysia as the ASEAN Digital Capital.” And all these were for a Huawei in their weakest. They are booming again in 2023 and so are a lot of Chinese tech giants and sectors. Like electric cars. Already bound to dominate in SEA you see them capturing markets just in the US doorstep

Even if you wanna hyper focus on chip exports. China already has a great shot in dominating mid and low end chip production and exports everywhere within the next decade and there is little real ability or plan from the west to counterbalance that legacy chip domination. How will that coexist as a reality with them being completely cut off fin the high end sector when they reach parity. I dont think it can .

Good article on the subject in Chinese https://www.guancha.cn/ChenFeng3/2023_02_14_679722_s.shtml

when you say deviate what do you mean? Their chips will be incompatible with our tech? What would be the barrier to making chips that are compatible?

deleted by creator

Well see, if we don’t sell them chips to the gosh darned chai-neeeese they’ll never be able to figure it out

The US government has been taken over by Chinese government agents who are implementing economic protectionalism for the Chinese semiconductor industry through the most round-about method possible.